Update 8.15pm: Enda Kenny, speaking to RTÉ, said: “It is important that we should appeal the decision to the European Court to get legal clarity and legal certainty on it.

“Beyond that I make no apology whatsoever for defending the right to appeal this because this is about Ireland, it is about our people, it’s about us as a sovereign nation, actually setting out what we consider our appropriate policies to devise job opportunities and employment careers for our people.”

He also said he was pleased with the outcome of this morning’s Cabinet meeting “at which a very clear decision had been taken not only to appeal the finding, but to also to reiterate our commitment to the 12.5% corporate tax rate in a very constructive and professional manner.”

Taoiseach makes 'no apology' for defending right to appeal EC decision

— RTÉ News (@rtenews) September 2, 2016

- Full interview on RTÉ's Six One News pic.twitter.com/wOL98YSkFR

Update 4pm: Sinn Féin says the decision by Cabinet to appeal the EU’s €13bn Apple tax ruling is “just wrong”.

The party is also demanding that the full ruling be published before the Dáil debate.

Deputy leader Mary Lou McDonald claims Government’s did facilitate tax avoidance and is “covering their asses for decisions that were taken and not taken over a very long period of time”.

Update 2pm: Independent TD Katherine Zappone said there would be a number of measures to “ensure tax justice” as the Cabinet confirmed its decision to appeal the Apple tax ruling.

There are five steps to the Government’s approach (listed in full below), including asking the Attorney General to prepare the legal grounds in support of an appeal.

“It would have been my preference that it was debated in the Dáil prior to making a decision,” said Deputy Zappone.

“I compromised on that in relation to accepting that as a Government and a Cabinet, we would take this decision.”

Meanwhile, Junior Minister John Halligan said that he now supports the decision to appeal, saying the Government does not need to be de-stabilised with the Budget and Brexit on the horizon.

The Waterford TD said: “I believe Apple should pay the money but I’ve also made my position clear that I don’t think the Government should be brought down on this issue.

“For the first time ever in the history of the State there will be an independent review as to what tax is paid by the multinationals, and are they paying fair tax.”

Earlier:

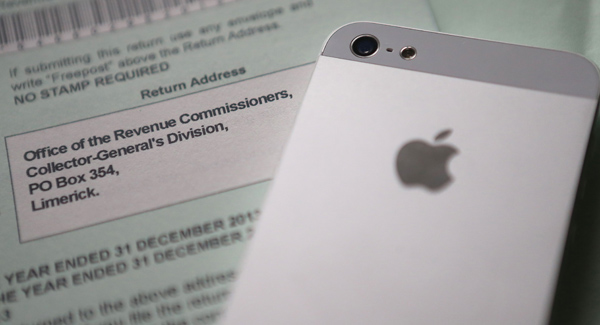

The Cabinet has agreed to appeal the Apple tax ruling.

Ministers have been meeting at Government Buildings following the European Commission ruling that Ireland should recoup €13bn in back taxes from the tech giant.

The Dáil will be recalled next Wednesday to discuss the issue.

The meeting ended after around 50 minutes with the Cabinet deciding that an appeal will be launched against the ruling by the Commission.

The Attorney General will draft the grounds for the appeal.

The Dáil will debate and vote on a motion next Wednesday to be drafted by the Government, effectively endorsing the decision to go for an appeal.

It is also believed that the motion will have strong words on the 12.5% Corporation Tax rate, because the Government feels that the decision by the Commission is an attack on the tax rate “by the back door”.

Kevin ‘Boxer’ Moran of the Independent Alliance said they had been working with Fine Gael to deliver a decision that takes into account all of their concerns.

Deputy Moran said: “We have been carefully examining the entirety of Apple’s tax treatment to ensure that any decision reached is in the best interests of this country over the long-term. The integrity of the tax system and to provide tax certainty to business is also paramount.

“I feel that the motion being put before the Dail will succeed in addressing our key concerns.

“I am also pleased to say that the Government has agreed to a review of Ireland’s corporation tax system by an independent expert to be appointed by the Minister for Finance.”

Mr Moran said it reflects the Independent Alliance’s approach of greater scrutiny of major decisions and the need for accountability and transparency at the heart of Government decisions.

The Government’s five-step approach is as follows:

* Arrange for annulment proceedings to be brought before the General Court of the European Union (GCEU) on State aid SA. 38373 (2014/C)(ex 2014/NN) (ex 2014/CP) implemented by Ireland to Apple;

* Request the Attorney General to prepare the legal grounds in support of those proceedings and to take all other steps incidental to the conduct of those proceedings;

* Propose the following motion before Dáil Eireann, that Dáil Éireann:

– Supports the Government decision to appeal the European Commission’s decision that Ireland provided unlawful State aid to Apple.

– Commits itself to the highest international standards in transparency in the taxation of the corporate sector;

– Resolves that, no company or individual receives preferential tax treatment contrary to the Tax Acts and calls on the Revenue Commissioners to continue to observe this principle;” and

* To reaffirm Ireland’s 12.5% Corporation Tax rate

* To arrange for a review of Ireland’s corporation tax system by an independent expert to be appointed by the Minister for Finance, excluding the 12.5% corporation rate.